Tech upgrades: a great way to boost home value

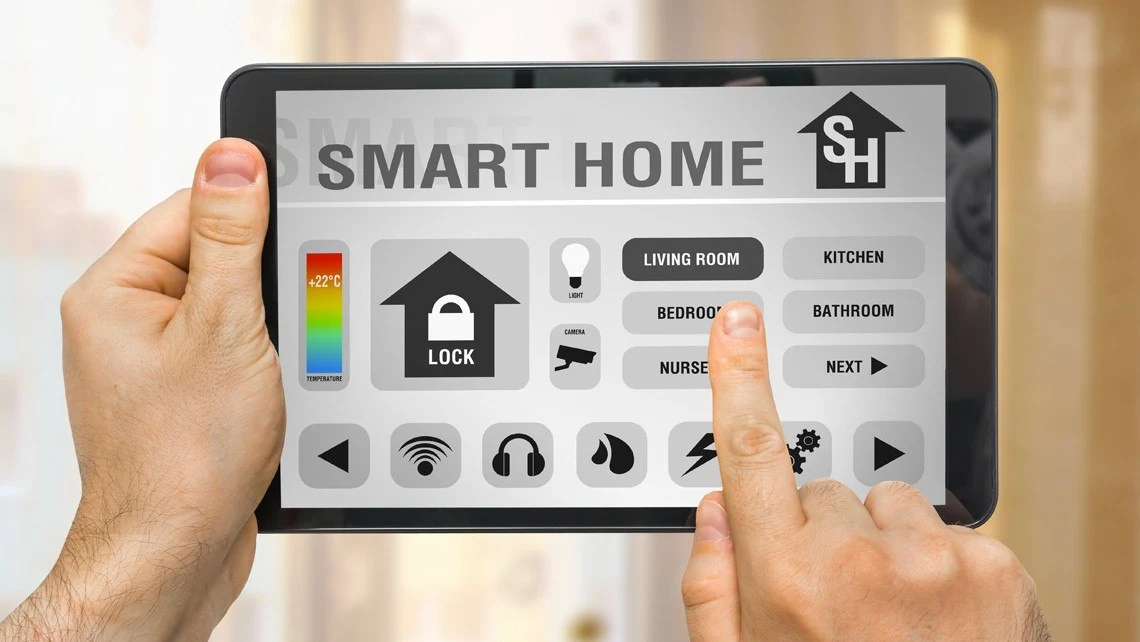

If you're going to pull money out of your bond account to make some home improvements, a great way to spend it would be on some Smart tech upgrades, says Rudi Botha, CEO of BetterBond, SA's leading bond originator.

"Making your home more tech-savvy will definitely boost its value – and your equity – while also improving your security and comfort and having the potential to lower your water and electricity bills," he says.

"Using Smart technologies is also relatively inexpensive. For example, many homeowners are now replacing all of their existing light bulbs with various types of Smart bulbs that they control remotely via an app on a Smart phone or tablet. You can also programme them to give off more or less light, to turn on and off in various parts of your home to simulate occupancy while you're away and to turn on at sunset and off at sunrise.

"This improves energy efficiency as well as security and can be a valuable cost saver after the initial investment. A starter kit for this type of installation costs around R5,000, and you can add extra bulbs from about R800 to R1,500."

Other "cool" and trendy tech upgrades to your home that are definitely worth exploring, Botha says, are:

- Digital assistants such as Google Home or Amazon's Alexa. These are essentially voice-controlled "helpers" that use wi-fi to enable you to turn on music or stream it, and control your Smart TV, lighting, plug points, door locks and temperature devices like fans and aircon units, without getting off the couch. Outdoors, you can also control a garden watering or irrigation system.

- Smart fridges that do so much more than keep food cold and make ice. For example, allowing you to view what's on the shelves via your Smart phone so you can plan what to buy and what to make for dinner or send you an alarm when the power goes off. Some models will also "learn" what food items you regularly consume and produce a weekly shopping list of only things that need replacing. You save money by not buying what you don't need and by not having food spoil in the fridge.

- Wireless Smart door bells. You can now get rechargeable battery-powered models that use wi-fi and an HD camera to send a chime and a video of who's at your door or security gate to your Smart phone.

- Digital door locks. These are also great for security because they enable you to control access to your house via your Smart phone or digital assistant. You don't have to worry about losing keys, forgetting to lock up or leaving a key somewhere for a guest, pet sitter or repair person.

- Smart watering systems. These enable you to set garden watering or irrigation schedules and control them remotely, and also respond automatically to cooler or rainy weather by watering less. They can also be big cost-savers, especially in areas where local authorities have imposed water restrictions and fines for over-use.

"These are the type of improvements that really appeal to modern buyers, along with "green" upgrades like solar geysers, heat pumps, gas stoves and rainwater storage tanks. They generally give you a very good return on your investment if you decide to sell your property," he notes.

"But it is much better to finance them by re-using some of the equity you have built up in your home for a few years than by taking out a high-interest personal loan, for example, or using your credit card. And this is especially true if you got your original loan through a reputable bond originator like BetterBond, because we use a multiple bank application process to make sure you get the lowest possible interest rate from the outset.

"We do this because we know that even a 0.5% difference between the best and worst rate offered could translate into very significant savings for the borrower. On a loan of R1.5m, for example, the potential savings with a 0.5% lower rate amount to more than R120,000 worth of interest over the 20-year lifetime of the loan, plus some R6,000 a year off the home loan instalments – which itself could pay for quite a few tech improvements."

*BetterBond is SA's biggest bond originator, accounting for 25% of all new mortgage bonds registered in the Deeds Office annually. Its statistics are thus a reliable indicator of the state of the residential real estate market.

Related articles

Homebuyers guide

How much can you afford?

Your dream home is closer than you think. Make your budget work with the help of our range of calculators